|

|

Very often, the option traders hears this term called "Covered Call Option" or "Covered Call Writing Position". In this article, we cover the details of the Covered Call Options trading, an example of Covered Call Options Position and explain it with a Payoff Function / Chart for Covered Call Position.

To understand Covered Call options position, you must understand the call option position first, both on the LONG CALL position and the SHORT CALL position. Here are the articles for Short Call Option Explained and Long Call Option Explained.

Once you are clear about the Long and short of call options, we'll then be ready to move on to the combinations - i.e. what you get when you take 2 positions in different assets.

Covered Call Option Trading Explained with Example & Payoff Function

A covered call, is a combination of a long Position in the underlying stock and a short call position. Generally, the short call position is the OTM call position (See What is OTM - OTM Out of the Money Call Put Options: Moneyness of Options).What is the benefit of the Covered Call Option Position?

To understand why and how of the Covered Call Option, you must look at the risks of each of the parts of the Covered Call combination individually. To understand that, here is the

Payoff function for Covered Call Option

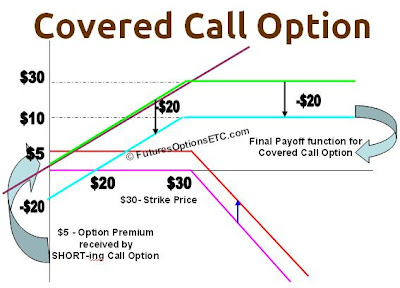

: Suppose that Microsoft stock (i.e. the underlying, not the option) is currently trading at $30 per share and you have a long position in that stock - i.e. you bought shares of Microsoft at the price of $25 per share. This Long position is indicated in the payoff function with a PLUM colored slanting line.

Now what is the risk of this stock position? The risk start coming in when the price of the stock goes below your buy price i.e. $25. Hence, say if the Microsoft stock price goes to $20, then you are in a $5 loss straightaway.

Now, what should you do to limit your losses??

Let's add a SHORT CALL position to this Stock position. Remember, we are talking about the OTM or out of the money Call option, so let's take a short position in Microsoft with a $30 strike price call. This is indicated in the payoff function for Covered Call Option Position in PINK color.

Now, suppose that this SHORT call position you sold for $5. Since this is a SELL, you will get this amount of $5. Hence, the PINK short call option payoff function will shift upward by $5 and you will get the RED short call option payoff function, which takes into account the $5 price.

Now, we have the 2 positions which we can add to get the combination.

Let's concentrate on the PINK and the PLUM colored graphs and we will take the price into account later.

Below the strike price of $30, the payoff from SHORT call position (PINK) is ZERO, while the PLUM position of the Long stock is increasing. Hence, in the range 0 to $30, the addition of these 2 positions will give you same PLUM colred position.

Above $30, the short call is going downwards (slanting position of PINK graph), while the stock position continues to go upwards. The upward and downward slopes will cancel out each other and you will get a net horizontal line. But the question is, where will this line start at?

The answer is simple. Since we are taking the range above $30, this horizontal line will start at $30 and keep proceeding further towards right till infinity.

Hence, what you get is the net payoff function of the Covered Call which is indicated in GREEN in the following payoff function for Covered Call Option position.

As stated earlier, between 0 and 30, it is same as the LONG stock position PLUM graph, while above $30, it is a horizontal line at $30 level.

However, this is the theoritical value as we are considering the graphs without taking price into account (only PINK and PLUM graphs).

So let's account for prices also. You bought shares at $25 and received $5 from the sale of the short call option position. So NET you paid $25 - $5 = $20. Since this is a net Payment from your side, it means that we need to shift the GREEN graph downwards by $20 to get the net payoff function for Covered Call Option position. That is what you receive which is indicated by the TURQUOISE or BLUE colored payoff function.

Related :Video Tutorial of Covered Call Option Explained

Now, let's head to the Profit & Loss Calculations for Covered Call Option Trading

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment