|

|

As mentioned in our previous article Bull Call Spread: Trading Example, The Bull Call Spread is one of simple options spread trading strategy which can be constructed simply by taking 2 positions:

1) Buy or Long an In the Money (ITM) Call Option and

2) Sell or Short an Out of the Money (OTM) Call Option

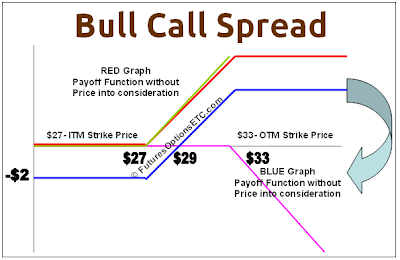

Let's see how this adds up in the Payoff function for Bull Call Spread:

Suppose that IBM stock is trading at around 30 $ per share and you have a bullish view on IBM. So what you do is, for the first ITM position, you BUY or go LONG an ITM Call Option on IBM with strike price of $27. This position is indicated in the payoff function with the PINK graph. Suppose you pay $4 for buying this call option.

Second, you have to SELL or SHORT an OTM call option on IBM, so let that be of a strike price of $33. This is indicated by the GREEN graph in the payoff function. Suppose you receive $2 from the sale of this option position.

Hence, your net payout for getting into a combination of these 2 positions is -$4 (Buy) +$2 (Sale) = $2. Therefore, to get into this example Bull Call Spread position, you pay a net of $2.

Payoff Function Chart of the Bull Call Spread

Now, let's add these 2 positions and take into account the net outflow of $2 to come to a realistic payoff function chart of the Bull Call Spread.Between 0 and $27, both the PINK and GREEN Graphs are ZERO (horizontal lines), hence on adding the two graphs you will get ZERO. This is indicated by the horizontal line of the RED graph in the 0 to 27 region.

Above $27 and upto $33, the GREEN graph is slanting upwards while the PINK graph is still zero. So when you add the two, you get the NET equal to the GREEN graph. This is indicated by the slanting part of the RED graph.

Then, lastly above $33, the GREEN graph continues slanting upwards, while the PINK graph slants downwards. Hence both the up and down slants cancel each other and you get the horizontal RED graph above $33.

However, this RED graph still does not account for the net money you paid or received from this BULL call spread positions. So let's take that also into account. As indicated above, you paid a net of $2 (outflow) for this position, hence we need to shift the RED graph downwards by $2 (as its a net Pay) to get the realistic payoff function for Bull Call spread:

What is the maximum Loss in a Bull Call Spread?

As you can see from the above Payoff function BLUE graph, the maximum loss in the BULL Call Spread is the NET ($2 = -$4 + $2) you Pay to construct this bull call spread.

As a formula, Maximum Loss in Bull Call Spread = Net Premium Paid + Brokerages Paid

What is the maximum profit in a Bull Call Spread?

The maximum profit in bull call spread is capped.

Maximum Profit in Bull Call Spread = Strike Price of Short Call - Strike Price of Long Call - Net Premium Paid - Brokerages Paid

Compared to Naked Long Call Option, how is a Bull Call Spread benficial?

As explained in this article Trading Long Call Option, a naked call option will give you unlimited profit potential but the loss will also be 100%, as you are set to loose the entire premium you paid.

However, in a Bull call spread, both your profits and your losses are limited, and also the capital required for getting into a bull call spread is lower than that for a naked long call position. For e.g., following your bullish view if you buy only naked call option, you will be required to pay $4 per option position, while in a bull call spread, it is only $2 as the example quoted above.

One more thing to keep in mind is that you might be required to keep margin money for bull call spread position, as you are having a short position. That requirement varies from one options broker to another

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment