|

|

Continuing further from our previous article Bear Put Spread: Example with Payoff Charts Explained, here is part II of the same.

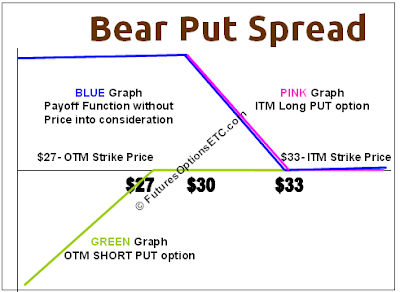

So, we were having the BLUE graph which was the net Payoff Function for the Bear Put Spread but without the price of Put options being taken into consideration. And as explained in the last part, we considered the prices as follows: the ITM Long Put Option will cost you $5 and OTM short Put Option position will get you $2. So the net you pay is $5 - $2 = $3 (Outflow). Let's account for this -$3 outflow into the BLUE payoff function graph to get the RED graph which is the real NET Payoff Function for the Bear Put Spread in the following diagram: Since there is a net outflow of $3, what we need to do is shift the BLUE graph down by $3 amount, to get the RED graph

A Quick summary so far from the Bear Put Spread Payoff Function so far:

- The Bear Put Spread is formed by Put options - one long and one short

- The spread trade will be profitable only if the price of the underlying goes down

What is the maximum Loss in a Bear Put Spread?

The maximum loss in the Bear Put Spread = Net Premium Paid + Brokerage commission paid

So in the above example, the net loss will be = $3 + Brokerage

What is the maximum profit in a Bear Put Spread?

The maximum profit in Bear Put Spread is capped.

Maximum Profit in Bull Put Spread = Strike Price of Long Put - Strike Price of Short Put - Net Premium Paid - Brokerages Paid

so in the above example, it will be $33 - $27 - $3 - Brokerages Paid = $3 - Brokerages Paid

When to trade a Bear Put Spread?

Spreads should always be traded when you have limited risk limited profit outlook in terms of P and L.

The Bear Put Spread is profitable only when the underlying stock or index price goes down i.e. bearish

Remember, you will be the net giver of the premium, as explained in the above example.

Also note the Breakeven Point for Bear Put Spread = Strike Price of Long Put - Net Premium Paid

= $33 - $3 = $30

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment