|

|

In our previous series, we had covered Trading Long Call Option, then we covered How to Trade a Short Call? Payoff Charts Explained and Long Put Option: How to Trade Long Put? Payoff Charts Explained. Now is the time to cover the last one in the 4 part series of plain vanilla Call put Options trading, and here we discuss the Short Put Option Trading Strategy

Short Put Option Trading Example Explained with Payoff Functions & Charts

What is the Short Put Option Trading?When you take a SELL position in a Put option, i.e. say you Sell (Short) a Put option on Microsoft with a strike price of $30, then you are said to have a Short Put Option Position. You receive money upfront from the sale of the Put option i.e. the option premium.

If on the expiry day, the price of the underlying microsoft stock goes below the strike price of $30, then the other party i.e. the buyer of the put option will get the right to exercise the option. Then you, as a seller of put option, will have to pay him the difference between the underlying on the expiry date (exercise date) and the strike price.

In case the underlying microsoft remains above $30, the put option expires worthless, and you (the seller) gets to keep the entire option premium.

What is the payoff for Short Put Option?

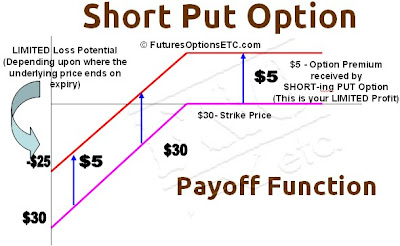

A Short Put is known as Limited Profit Limited Loss position. As you can see from the payoff function above, the PINK graph demonstrates the payoff function for your Short Put Option Position, but without taking the price (or option premium) amount into consideration.

As you can see from the PINK graph payoff function, as long as the underlying stock price remains above $30, the PINK graph remains a straight horizontal line - i.e. the option is NOT exercisable, and you dont need to pay anything to the buyer.

However, below $30, the PINK graph takes a slanting curve, and becomes exercisable. Hence, you need to pay to the buyer the difference between the strike price and the then underlying price.

Now, look at the RED graph of the Short Put Option Pay off Function. It takes into consideration the price you received for sale of put option ($5).

As long as the underlying price remains above strike price of $30, the option remains UN-EXERCISABLE. Hence, you are in profit as you as a seller, get to keep the entire $5 you received from sale of this put option.

However, once the underlying price goes below $30 strike price, the put option becomes exercisable and you will be required to pay the difference to the buyer. But what is shown in the slanting part of the RED payoff function is that it takes into consideration the money you received $5 for sale of put option.

Related: Video Tutorial: Short Put Option Trading Explained

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment