|

|

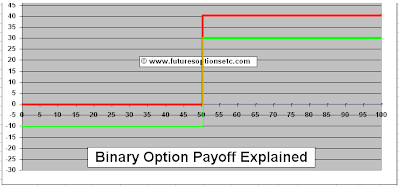

Continuing further from our previous article on Binary Options Example Explained, here we present the Payoff Functions of Binary Options

Different Types of Binary Options

There can be several types of Binary Options - depending upon the payoff functions profit and loss regions. The same binary option may look different from a BUYER's perspective and completely different from a SELLER's perspective.

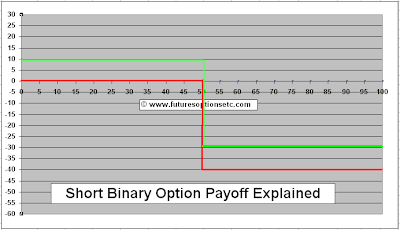

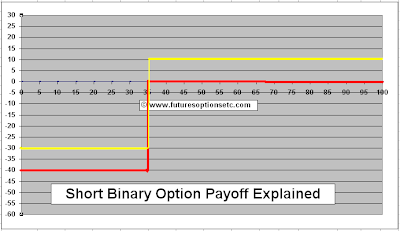

For e.g. the above payoff function was constructed from a buyer's side. The same payoff function when constructed from a seller's side will look like the following:

The RED payoff function for Binary Options is without the price being considered from seller's perspective. If the underlying stock price remains below $50, then seller looses nothing. But if it goes above $50, he has to pay $40 to the buyer. The $50 is the strike price of the binary call option.

The GREEN payoff function for Binary Option is with price of $10 taken into consideration. If the underlying stock price remains below $50, the seller looses nothing. In fact he is in profit of $10 which he received earlier and he keeps that as a profit.

But if the stock price goes above strike price of $50, then he ends up in a loss of $30 ($40 to be paid to the buyer minus $10 he received upfront).

We can call this one a Short Binary Call Option (from seller's side) and the earlier one as Long Binary Call Option (from Buyer's side)

Payoff Functions of Binary Options

One more important thing to note about the above 2 cases of Long and Short Binary Options is that the all or nothing regions extend to the end points. For e.g., in case of Long Binary Option, the profit region (All) is above $50 to infinity, while the loss region (Nothing) is from $0 to $50. Vice Versa for the Short Binary Option case.

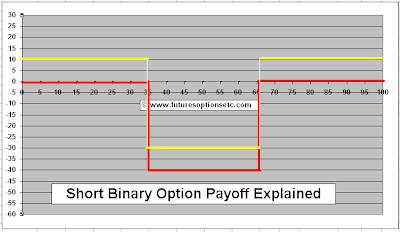

There are still other kinds of Binary Options which have restricted profit and loss regions confined to a particular limit. For e.g. instead of profit region for a long Binary Option being open from $50 to infinity, it may be limited from $35 to $65 and again a loss region above $65.

These kind of limited range binary options are also called as Binary Options Tunnels

Here is an example payoff function of such a Binary Option:

RED colored graph - without price taken into consideration

YELLOW colored graph - price of $10 taken into consideration

In this case, The buyer is paying $10 to buy this Binary option. If the underlying stock price remains between $35 and $65, the buyer of the Binary Option will get $40 (Net $30 = $40 - $10). But if the underlying stock price remains below $35 (between 0 and $35) or goes above $65, then he gets nothing (Loss of $10).

In case of binary option tunnel, there are 2 strike prices. In the above example, the 2 strike prices are $35 and $65.

Here is the same position of Binary Options Tunnel from the seller's perspective:

In this case, the seller is receiving $10 from the buyer of the binary option. If the underlying stock price remains below $35 or goes above $65, then the seller will get to keep the $10 he received from the buyer (ALL). But if the underlying stock price remains between $35 and $65, then he needs to pay $40 to the buyer (Net loss of $30 = $40 - $10)

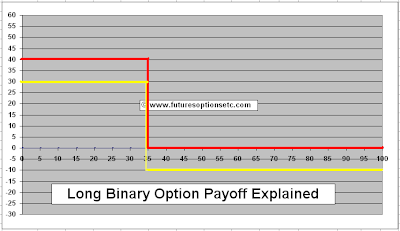

Then there are some other forms of Binary options which are profitable to the buyers, but on the other side – they are similar to the PUT Options hence they are called the Binary Put Options

For e.g., say there is a binary option which gives opportunity to the option buyer to receive $40 if the underlying stock price remains below $35 and receive nothing if option price goes above $35. Here is the payoff function for such Long binary option (Buyer's side - assuming he paid $10 to buy this Binary Option):

And here is the same binary option payoff function from the seller's side (he receives $10 for selling the Binary option):

Let’s now see the Greeks for Binary Options : Delta, Gamma, Rho, Vega Theta

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment