|

|

Continuing further from our previous article Ratio Put BackSpread Options Trading: Profit & Loss Calculations, here are the Details about Greeks (Delta, Gamma, Rho, Vega Theta) for Ratio Put BackSpread Option Trade

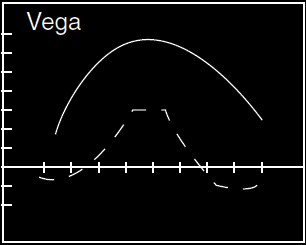

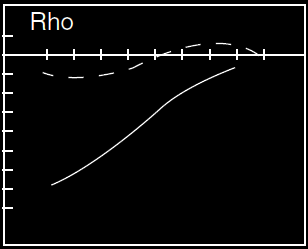

Dotted line indicates a shorter maturity option Greeks while the solid line represents the long maturity option Greeks.

Ratio Put BackSpread Option Greeks: Delta, Gamma, Rho, Vega, Theta

Delta for Ratio Put BackSpread Option:

Delta for Put Ratio BackSpread Options goes higher in magnitude (but negative) as the underlying stock continues to fall. The higher the underlying prices goes the less sensitive the option price becomes to underlying price changes.

Gamma for Put Ratio BackSpread Options

The second derivative with respect to the price - it takes maximum value around lower strike price

Theta for Put Ratio BackSpread Options

Time decay will hurt the option trader as long as the stock is not deep in the downward trend.

Vega for Put Ratio BackSpread Options

Volatility is better - the higher it is the higher the chances of big price movements

Rho for Put Ratio BackSpread Options

Higher interest rates are bad for this Put Ratio BackSpread Options position.

Put Ratio BackSpread Options

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment