|

|

This series of articles will be dedicated to explaining the Ratio Call Spread Options Trading.

The name of "Ratio Spread" comes from 2 factors - (1) we have to take positions in long and short options as per a ratio (1:2) or (2:3) and (2) The profitability region is a spread and that's what the option trader expects to benefit from.

Before continuing further, a word of caution about Ratio Spread Options Trading is that these combinations involve taking multiple option positions (atleast 3) at entry and same 3 need to be closed (or exercised) at exit. First challenge may be to get the required options at the desired prices and second mandatory challenge is the cost of brokerage and commission which you end up paying for these multiple options trades. Hence, traders are advised to be aware of these risk parameters and costs.

Example of Ratio Call Spread Options Trading Explained

Now, let's begin with the details of Ratio Call Spread Options Trading:What is the Ratio Call Spread Options Trading Position?

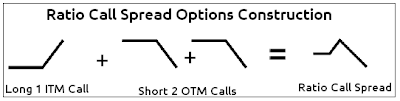

As the name suggests, an option trader needs to take multiple call option positions (long and short) in a defined ratio for taking a creating a Ratio Call Spread Options.

The ratio is either 1:2 or 2:3 or as decided by the trader based upon his selected options strategy. The resultant payoff function (as explained later in this series) is an limited profit, unlimited loss scenario, where the option trader can loose much more.

The strategy is profitable only when the underlying stock prices don’t make a large move and remain stable in a small region. The strategy can become a big loss making trade if the underlying stock price make a big large move in the upward direction only (unlimited loss potential) and limited loss if the underlying stock price declines on the downside.

Which scenarios are ideal for trading Ratio Call Spread Options?

The profit from Ratio Call Spread will be limited and will come only when the underlying stock price doesn’t move much. Hence, it will be profitable to trade Ratio Call Spread only when the option trader is expecting stability in the underlying stock price till expiry.

For e.g., if say Apple is trading at $50 per share (just an example) and in the next 2 months the price of Sun stock (underlying) is not expected to move beyond $55 on the upside and $45 on the downside. Hence, the underlying stock price is not expected to move much, an option trader can take a bet on Ratio Call Spread Options Trading in this case.

However, please note that there are multiple other similar options strategies available which also fit the same scenario. Some may come at much lower / much higher risk and different profit potentials. A trader can decide to take a call after understanding each of them.

- Short Straddles Options Trading

- Short Straddle Options Trading

- Long Call Butterfly Spread Options Trading

- Long Put Butterfly Spread Options Trading

Here is how the construction of Ratio Call Spread is done:

To understand it further, lets move on to Example & Payoff Charts of Ratio Call Spread Options

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment