|

|

Continuing further from our previous article on Ratio Call BackSpread Options Trading Example Explained, here are the details about the Payoff Functions for Call Ratio BackSpread Options Trading

How is a Ratio Call BackSpread Options Position constructed?

Ratio Call BackSpread Options Position is constructed using Call options (hence the name call) in a pre-determined ratio. An option trader can use 1:2 or 2:3 ratio, here in this example of Ratio Call BackSpread we will explain the same with a 1:2 ratio.

1) Buy 2 * OTM Calls (Long)

2) Sell 1 * ITM Call (Short)

(Want to know what is ITM, OTM, ATM in Options? See Moneyness of Options - OTM, ATM, ITM Options)

The sum of above 3 options positions give the following combination:

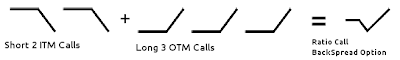

Here is another way to construct the same payoff position for Ratio Call BackSpread using 2 Long calls and 3 short calls. However, please note that the more options you trade to get in and out of options, the more options trading commission you need to pay.

For the remainder of this discussion, I will keep the 3 options combination for explanation of example.

Can we have an example of Ratio Call BackSpread Options Trading?

Suppose the Microsoft stock is trading around $50 and you expect it to move up with a big value, say to $80 in the next 2 months time. Hence, you decide to take the Ratio Call BackSpread with the following call options:

1) Long 2 OTM call at strike price of $60 at an option premium of $2 each

2) Short 1 ITM calls at strike price of $40 at an option premium of $11

Hence, you pay $4 for 2 Long positions and receive $11 for 1 short call, hence a net credit of $7 for this Ratio Call BackSpread Options Trading position.

Payoff Function for Ratio Call BackSpread Options

Here is the payoff function for Ratio Call BackSpread Options without the prices being considered.Please note that second $60 short call (Turquoise color) is hidden behind the first $60 short call (PINK colored), hence not visible.

Now, let’s add all of these 3 together to get the net ORANGE colored payoff function, which displays the profit and loss regions clearly. Please note that prices are still NOT considered: (Learn how to correctly add the multiple payoff functions: Mathematics of Options Trading: Adding Multiple Call & Put Options

Finally, let's consider the price also. The option trader paid a net $4 from these 3 options position combination. Since it is a net payout, we shift the ORANGE colored graph downwards to get the BROWN colored net payoff function with prices factored in:

Let's continue onto explanation of this Ratio Call BackSpread Profit & Loss Calculations

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment