|

|

Continuing further from our previous article Ratio Call BackSpread Options Trading: Profit & Loss Calculations, here are the Details about Greeks (Delta, Gamma, Rho, Vega Theta) for Ratio Call BackSpread Option Trade

Dotted line indicates a shorter maturity option greeks while the solid line represents the long maturity option Greeks.

Short Call Butterfly Option Greeks: Delta, Gamma, Rho, Vega, Theta

Delta for Ratio Call BackSpread Option:The delta value remains high on the upside of underlying value as more and more upside price movements of the underlying makes the option position more sensitive to underlying price change.

On the lower side, the delta value becomes more and more insensitive as the underlying stock price falls lower and lower and hence on the lower side, the delta value is zero.

Gamma for Ratio Call BackSpread Options Trading:

Gamma is the first derivative of delta and second derivative of the underlying stock price. Hence, it has a high value around the middle of the two strike prices

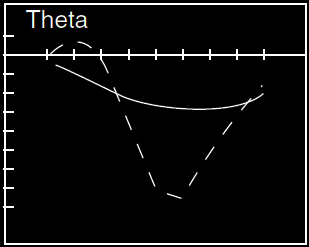

Theta Ratio Call BackSpread Options Trading

Time decay derivative - bad and loss causing for option trader in Ratio Call BackSpread in the loss region and upper profit region. Its effect becomes negligible only when there is a big sharp price decline in the underlying.

Vega for Ratio Call BackSpread Options Trading

Increasing volatility is helpful for the Ratio Call BackSpread position as that increases the possibility of underlying stock price breaking into the profit making regions either on the upside or the downside.

Rho for Ratio Call BackSpread Options Trading

Effect of interest rate changes on the option position is measured by Rho. When the underlying stock prices are on the rise, the increase in interest rates is good and benficial for the Ratio Call BackSpread.

Ratio Call BackSpread Options Trading

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment