|

|

Continuing further from our previous article on Binary Options Trading Explained, here we present the Example of Binary Options Trading

Can we have an example of Binary Options?

Here is An example of Binary Options:

Assume that IBM stock price is currently trading at $40 and there is an option trader named 'A' who believes that IBM stock price will go above $50 in next 2 months time. There is another option trader B who believes that IBM stock price will remain below $50.

Assume that A buys a Binary Option from B by paying a price of $10 and on a condition that IBM stock price will go above $50. A is the buyer of this Binary Option and B is the seller.

A & B agree that if IBM stock price touches $50, then B (seller) will pay $40 (the pre-determined payoff) to A (buyer).

In this case, A wins this Binary Options bet, and gets $40 from B. Since he had earlier paid $10 to get into this Binary Option trade with B, A's net profit is $40 - $10 = $30.

This threshold price based upon which the winner is decided becomes the strike price of the binary option.

Binary Option Example

If IBM stock price stays below $50, then B (seller of Binary Option) will not pay anything to A.

In this case, A looses the Binary Options and gets nothing from B. B wins and gets to keep $10 which he received while getting into Binary Option trade with A.

So in either case, from A's perspective (buyer's side), its ALL ($30 net profit) or NOTHING ($10 loss) - theoretically, its ALL ($40 profit) or NOTHING ($0)

From B's perspective (seller's side), it's ALL (net $30 to pay) or NOTHING ($10 to keep) - theoretically, its ALL ($10 profit) or NOTHING ($40 loss)

Hence, only 2 outcomes for both Buyer and Seller. Both know well in advance what they will receive as profit if their favorable condition is satisfied. Both know in advance what they will loose as loss if their favorable condition is not met.

Hence the term binary option - only two outcomes - with pre determined amounts of profit and loss for both buyer and seller of binary option.

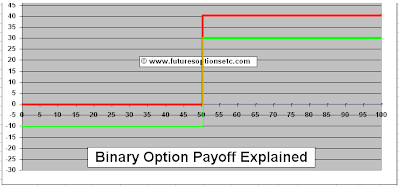

To understand it better, here is the payoff function for the above case:

As you can see, the RED colored payoff function does NOT take into account the price paid for this Binary Option. The RED graph indicates that if the underlying stock price remains below $50, the BUYER of this Binary Option will not get anything (ZERO payoff - horizontal RED line between 0 and $50). However, the moment the underlying stock price reaches $50 (or above), the payoff shoots up to $40 (horizontal RED line above).

However, nothing in this world comes for free. So we need to account for price paid by buyer for this Binary Option ($10). Since this is paid by the buyer (net outflow) we need to shift the red graph DOWNWARDS by $10 and we get the GREEN payoff function for the Binary Option. This GREEN payoff function includes the price.

What this GREEN payoff function tells us?

It indicates that if the underlying remains below $50, then the Binary Option buyer will loose the $10 he paid for this Binary Option. The moment underlying stock price reaches above $50, the net payoff to the buyer shoot up and jumps to net $30 ($40 received as payoff minus $10 paid upfront).

Hence, only 2 outcomes: +$30 or -$10 i.e. ALL or NOTHING.

Like a Switch - ON or OFF - no other possibility in between.

Let's continue to understanding the Binary Options better through Payoff Functions: Binary Options Payoff Functions

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment