|

|

Continuing further from our previous article on Ratio Put BackSpread Options Trading Example Explained, here are the details about the Payoff Functions for Put Ratio BackSpread Options Trading

How is a Ratio Put BackSpread Options Position constructed?

Put Ratio BackSpread Options is constructed using Put options in a particular ratio (for long and short)- usually the ratio of buy to sell puts is 2:1 or 3:2 i.e. the option trader taking Put Ratio BackSpread position is net buyer.

Here are the details about construction of Put Ratio BackSpread :

If you wish to construct it with 3:2 ratio, then here is how it will look

But do note that higher no of put option positions will mean higher brokerage costs.

For the remainder of this discussion, I will keep the 3 options combination for explanation of example.

Can we have an example of Put Ratio BackSpread Options

Suppose the IBM stock is trading at a price of $50 per share. You as an option trader, expect that IBM might take a big hit and might come down to $20 or so. How can you use Put Ratio BackSpread Options to benefit from this prediction, if it happens to come true?

Suppose you just short the IBM stock and it indeed goes down to $20 from $50. Hence your profit will be $30. But you may be required to keep margin for short stock as demanded by your broker.

Other option is to buy a long put of say $50 strike price for a price of say $5. However, the problem is that if the underlying stock price goes above $50, then you will loose your entire $5 (100% loss).

Now let's see how the Put Ratio BackSpread Options can help.

1) Long 2 * OTM Put Options at an option premium of $3 each

2) Short 1 ITM Put Option at an option premium of $12

i.e. you are buying 2 put options with strike price of $45 at a option premium of $3 each.

You also short one put option with a strike price of $55 at a option premium of $12. Hence you net receive ($12 - 2*$3 = $6) from this position.

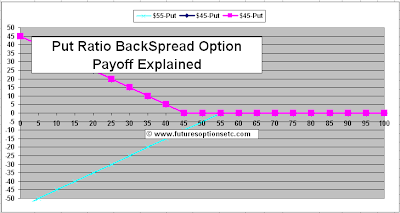

Put Ratio BackSpread Options Payoff Function

Here is how the individual option positions will look without considering the prices paid.

Please note that the DARK BLUE colored payoff function for the second long put option is hidden behind the similar PINK colored payoff function, hence not visible.

Now let's add all these 3 positions together - Please note that prices are still NOT considered: (Learn how to correctly add the multiple payoff functions: Mathematics of Options Trading: Adding Multiple Call & Put Options

Finally, let's consider the price also. The option trader received a net $6 from these 3 options position combination. Since it is a net pay-in (or payment received), we shift the ORANGE colored graph upwards to get the BROWN colored net payoff function with prices factored in:

Let's continue onto explanation of this Ratio Put BackSpread Profit & Loss Calculations

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment