|

|

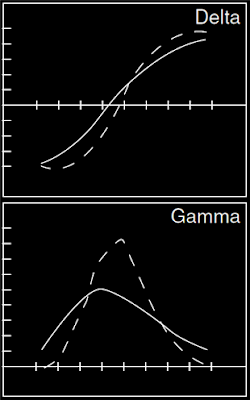

Details about Greeks (Delta, Gamma, Rho, Vega Theta) for Long Straddle Option Trading

Dotted line indicates a shorter maturity option Greeks while the solid line represents the long maturity option Greeks.

Greeks form an important quantitative measure for any option trade. Here are the details for Long Straddle Option Trade and their corresponding Greek Values.

Delta for Long Straddle Option : it measures the speed at which the option price moves with respect to the underlying. The magnitude of the Delta is highest in either direction at extreme ends meaning the Long Straddle option prices will move high as the underlying moves on either side.

The negative value on the lower side of the Delta graph simply indicates the direction - it will still be profitable to the Long Straddle Option Trader.

Gamma for Long Straddle Option Trading:

As can be seen, the highest value of Gamma is somewhere near the ATM strike price and then it goes down in either direction - indicates that this highest point (ATM strike) is the turning point of profit direction. It might be mistaken for loss, but in either direction it is profitable to the Long Straddle Option trader

Long Straddle Greeks: Delta, Gamma, Rho, Vega & Theta

Theta for Long Straddle Option Trading:

Time decay is the biggest culprit for the Long Straddle Option Trader. It eats away all the profit if the underlying stock doesn't move much.

It has its worst effect when the underlying price stays at the ATM strike price, as shown in the graph.

Vega for Long Straddle Option Trading:

If nothing else changes, the higher implied volatility will keep the options prices high which will be beneficial to the Long Straddle Option trader. Hence, Vega graph peaks at the center

Rho for Long Straddle Option Trading:

Rho measures the interest rate sensitivity to option positions.

Higher values of interest rates will help the Long Straddle Option Trader as indicated in the graph

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment