|

|

Short Butterfly Spread offers the options trader a limited risk limited profit potential - traders should get into this Short Put Butterfly Spread Option trading when they do expect the underlying stock or index to move much rather than remaining in a confined or limited price range.

What is a Short Put Butterfly Option position?

A Short Put Butterfly Option offers capped (limited) profit and capped (limited) loss potential.

The name comes from the payoff function shape (see below) which resembles a butterfly - in this case an inverted butterfly, hence the name SHORT BUTTERFLY. There are 2 LONG PUT and 2 SHORT PUTS required for this Short Put Butterfly Spread Option trading. Since it is constructed with Put options, hence the name includes PUT.

It is usually a net credit position i.e. the option trader taking the Short Put Butterfly Spread Option position can expect to receive a net option premium upfront.

Short Put Butterfly Option Payoff Function Explained with Example

How is the Short Put Butterfly Spread Option constructed or configured?The Short Put Butterfly Spread Option can be constructed by taking 4 option positions -

1) 1 * ITM Short Put

2) 1 * OTM Short Put and

3) 2 * ATM Long Put positions.

(Want to know what is ITM, OTM, ATM in Options? See Moneyness of Options - OTM, ATM, ITM Options)

Theoretically, here is how it looks:

Can we have an example of Short Put Butterfly Spread Option ?

Suppose that IBM stock is trading at around $50 per share (the underlying) - just for an example. Using your own research or forecasting mechanism, you come to a conclusion that the IBM stock price might make a big move either direction in the next 2 months and can either reach $80 on the upside or fall down to $20 on the downside.

So this makes an ideal scenario to go for the Short Put Butterfly Spread Option Position.

Hence, you SELL (or go SHORT) the following:

1 ITM Short PUT with Strike price of $55 at a option price of $8

1 OTM Short PUT with Strike price of $45 at a option price of $3

and you BUY (or go LONG) the following

2 ATM Long PUT with Strike Price of $50 at a option price of $4 each.

Hence, you receive a net $8 + $3 = $11 for 2 Shorts, while you pay $4 + $4 = $8 for 2 buys. Overall net credit for your Short Put Butterfly Spread Option comes to $11 - $8 = $3

Payoff function for Short Put Butterfly Option

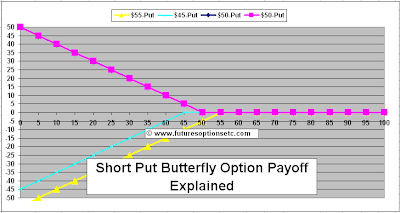

Here is the payoff function for Short Put Butterfly Spread Option with all 4 options without the price being considered:Please note that PINK and BLUE are $50 Put Options payoff functions, with PINK one covering BLUE one, so BLUE payoff function is not visible.

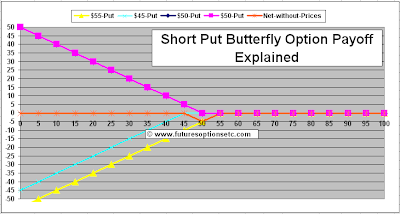

Now, let's add them up together to get the NET ORANGE colored payoff function of Short Put Butterfly Spread Option - note that price is still NOT considered:

Finally, let's make the adjustment for the net price of $3 you received to construct this Short Put Butterfly Spread Option and here we get the BROWN colored final net payoff function for Short Put Butterfly Spread Option with price factored in:

Let's continue onto explanation of this Short Put Butterfly Payoff Functions and Profit & Loss Calculations

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment