|

|

Details about Greeks (Delta, Gamma, Rho, Vega Theta) for Short Put Butterfly Option Trade

Greeks form an important quantitative measure for any option trade. Here are the details for Short Put Butterfly Option Trade and their corresponding Greek Values.

Dotted line indicates a shorter maturity option Greeks while the solid line represents the long maturity option Greeks.

Delta measure the price sensitivity of the option price to its underlying.

The Delta for Short Put Butterfly Option is at its highest value near the 2 outer strikes (ITM and OTM Put Strikes) and is lowest (zero) near the middle ATM strike.

Gamma is the second derivative of the underlying price movement sensitivity to option price (or the first derivative of delta).

Since Gamma is another derivative of delta, the sign would change compared to the delta graph for Short Put Butterfly Option. the magnitude will also diminish a bit due to the derivation. It will take the highest value near the middle ATM strike and goes lower near the outer strikes of OTM and ITM Puts.

Delta, Gamma, Rho, Vega Theta Greeks for Short Put Butterfly Option

Theta measures the time decay - see (Options Time Decay: Explained with Examples)

Time decay may theoretically look to benefit the Short Put Butterfly Option trader, but in practice it is beneficial only in the profit region, while it eats away the money for the trader in the unprofitable region of the payoff function.

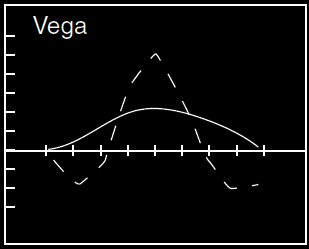

Vega measures the option price sensitivity to volatility.

In case of Short Put Butterfly Option, the higher values of volatility lead to profit to the option position

Rho measures the interest rate sensitivity to option positions.

As seen from the chart, an increase in interest rates is beneficial to the Short Put Butterfly Option position if the underlying stock price is higher and problematic in case the underlying stock price goes lower

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment