|

|

Continuing further with our series on the Gut Options Trading, we covered Long Gut Trading Explained with example in an earlier article. In this article, we will cover the details of Short Guts Option Trading and explain it with an example. Please note that shorting options is a risky trade with unlimited loss potential - please trade on such short trades only after fully understanding the risks of the same.

Before jumping onto getting into a Short Gut position, please read the entire set of articles to clearly understand the Short Gut trading and risk.

Long Gut Options trading offered the trader (option buyer) unlimited profit potential with limited risk. The reverse is true for SHORT GUT OPTIONS TRADING - it offers the trader (option seller) unlimited loss potential for limited profit potential.

Let us begin:

What is a Short Gut Option Trading position?

A Short Gut option position is formed when someone SHORTS (or sells) a ITM CALL and a ITM PUT.

(Want to know what is ITM, OTM, ATM in Options? See Moneyness of Options - OTM, ATM, ITM Options)

Note that in a Short Gut position, there are 2 Sells (shorts) i.e. 2 Short positions. Hence this means the seller getting into the (Short) Gut Option position is actually going to receive the 2 option premiums upfront. Hence a Short Gut options position is a net credit position where the trader receives the money (option premium) by selling the 2 options. However, please note that shorting options also requires margin money which may be very high compared to the option premium received hence the overall money requirement considering margin may be huge making Short Guts a debit position.

When is the Short Gut Option position useful to the trader (option seller)?

Please note the short Gut option position is for option sellers.

The Short Gut option position is useful to the seller when he/she is expecting a stable price within a given range in the underlying stock or index i.e. it will be beneficial to get into a short gut position only when you expect the price of the underlying to not change much and remain confined to a limited price range.

For e.g., assume that IBM is currently trading at $50 per share and you are convinced that in the next 2 months, it will continue to remain in the rang of say $45 to $55 i.e. IBM stock price will not go below $45 on the lower side and will not go above $55 on the higher side.

Hence, this becomes a case of limited range price movement and is an ideal scenario for getting into a SHORT GUT OPTION trade.

How is a Short Gut Options Trading position constructed or configured?

The Short Guts Options trading position is constructed with the following 2 individual SELL positions (SHORT positions):

1) A ITM (In-the-money) Call Option

2) A ITM (In-the-money) Put Option

Can we have an example of Short Gut Option please?

Yes. Assume that IBM stock is trading at $50 per share (the underlying stock price, not the option price).

You as a trader are sure that IBM will remain between $45 and $55 for the next 2 months.

Hence, this is a case of possibly limited range bound price movement in stock price. This makes it an ideal scenario to get into a Short Gut Option position.

So you decide to sell an ITM Call option on IBM with the strike price of $45 and and ITM Put Option on IBM with the strike price of $55.

The ITM Call sells for $8, while the ITM Put sells for another $8 i.e. total $16 - net credit to your account.

The Payoff functions for Short Gut Option Position

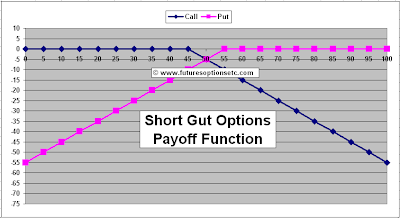

Here is how the 2 positions - 1 call (BLUE) and 1 put (PINK) will look in terms of the payoff functions - both shorts and without price being considered:

And now, let us draw the NET SUM payoff function by adding the above 2 positions (YELLOW Color graph). Note, that the price ( 8 + 8 = $16) is still NOT considered:

Now, finally let's introduce the price. Since we are receiving a net total price of $16 to get into the Short Gut position, the overall YELLOW graph will go up by 16 to give the NET PAYOFF Function of Short Gut OPTION position as the GREEN color graph:

Now that we are clear about the payoff functions, let's see the Profit & Loss Calculations for Short Gut Options Trading

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment