|

|

In this article, we will cover the details of Long Guts Option Trading and explain it with an example.

Imagine a trading position where one can receive unlimited profit, but has only a limited risk. Is it possible in real life scenario? The answer is YES. That's where the LONG GUTS OPTION TRADING position comes in. However, before jumping onto getting into a LONG GUT position, please read the entire set of articles to clearly understand the Long Gut trading and risk implications.

Long Gut Option Trading Explained with Example

Let us begin:What is a Long Gut Option Trading position?

A long gut option position is formed when someone BUYS a LONG ITM CALL and a LONG ITM PUT.

(Want to know what is ITM, OTM, ATM in Options? See Moneyness of Options - OTM, ATM, ITM Options)

Note that in a Long Gut position, there are 2 Buys i.e. 2 Long positions. Hence this means the buyer getting into the (Long) Gut Option position is actually going to pay the 2 option premiums upfront. Hence a long gut options position is a net debit position.

When is the Long Gut Option position useful to the buyer?

The long gut option position is useful to the buyer when he/she is expecting a sudden and big price movement in the underlying stock or index price, which can be in either direction (upwards or downwards).

For e.g., assume that a company like IBM is bidding for a big project which is worth billions of dollars. Just for example, assume if IBM is successful in winning the project, it will mean big profits for the company and hence the IBM stock price will move upwards significantly.

However, if IBM looses out on the project bidding, then it will mean the IBM stock price will come down significantly.

Hence, when there is a possibility of big move but the trader is not sure about the direction of the move, then the Long Guts Option Trading Position is beneficial.

How is a Long Gut Options Trading position constructed or configured?

The Long Guts Options trading position is constructed with the following 2 individual BUY positions (LONG positions):

1) A ITM (In-the-money) Call Option

2) A ITM (In-the-money) Put Option

Can we have an example of Long Gut Option please?

Yes. Assume that IBM stock is trading at $50 per share (the underlying stock price, not the option price).

You as a trader are aware that IBM is bidding for a multi-billion dollar project which if IBM wins will take the IBM stock price from $50 to $80, but if IBM looses the project bid, then its stock price might come down to $20 or so (just an example).

Hence, this is a case of possibly big move in stock price, but the direction of the move is not clear - it can be either way depending upon the result of the project bidding. This makes it an ideal scenario to get into a LONG GUT Option position.

So you decide to buy an ITM Call option on IBM with the strike price of $45 and and ITM Put Option on IBM with the strike price of $55.

The ITM Call costs you $8, while the ITM Put costs you $8 i.e. total cost of $16 - net debit from your account.

The Payoff functions for Long Gut Option Position?

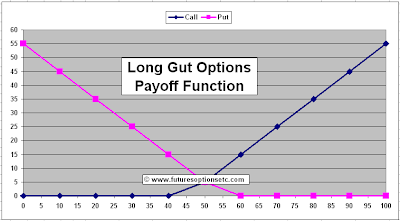

Here is how the 2 positions - 1 call (BLUE) and 1 put (PINK) will look in terms of the payoff functions.

And now, let us draw the NET SUM payoff function by adding the above 2 positions (YELLOW Color graph). Note, that the price ( 8 + 8 = $16) is still NOT considered.

Now, finally let's introduce the price. Since we are paying a net total price of $16 to get into the LONG GUT position, the overall YELLOW graph will come down by 16 to give the NET PAYOFF Function of LONG GUT OPTION position as the Turquoise color graph:

Continue onto Part II of this article

0 Comments: Post your Comments

Wish you all profitable derivatives trading and investing activities with safety! = = Post a Comment